Federal Reserve Governor Jerome Powell said Friday that he couldn't quite explain why inflation was running below the central bank's 2 percent target.

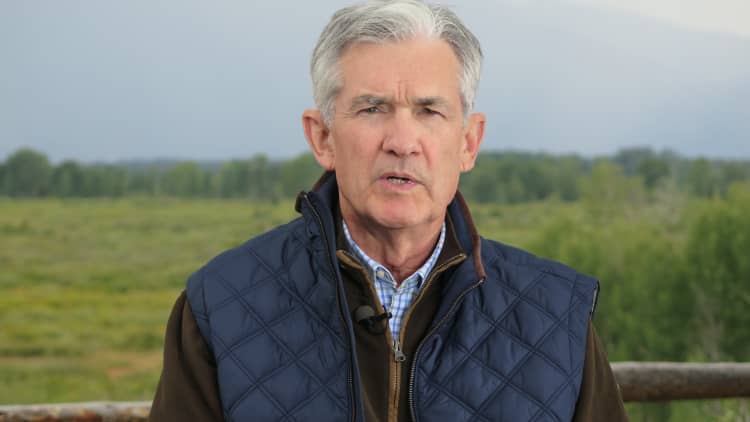

"Inflation is a little bit below target, and it's kind of a mystery," Powell said on CNBC in a live interview from Jackson Hole, Wyoming, where central bankers were gathered for an annual meeting.

"You would have expected given that we're getting tighter labor markets that we'd have a little higher inflation," he said. "I think that what that gives us is the ability to be patient" regarding future rate hikes.

Powell is a member of the Fed's Board of Governors and a voting member this year of the Federal Open Market Committee. The U.S. central bank raised interest rates twice this year and is still on track to hike one more time, although markets assign slightly less than a 40 percent probability of one, according to CME's FedWatch.

The Fed's preferred inflation measure is the core personal consumption expenditures price index that excludes food and energy. The latest read, released earlier this month, showed a 1.5 percent increase in the 12 months through June, little changed in pace from May. The Fed has a 2 percent target.

On the other hand, the July jobs report showed a second straight month of more than 200,000 new positions, while the unemployment rate fell to 4.3 percent, its lowest since March 2001.

Treasury yields traded near session lows, with the rate-sensitive near 1.33 percent as of 2:36 p.m. ET. The dollar weakened and the euro strengthened to $1.187, its highest against the greenback since Aug. 4.

U.S. stocks were slightly higher Friday afternoon on renewed hopes for tax reform. Treasury Secretary Steve Mnuchin said earlier Friday that President Donald Trump is committed to getting tax reform done this year.

"I have assumed there will be some kind of tax action next year," Powell said. But "until it's clearer what it is, then I think it's actually hard to put it into your forecast."

Earlier in the day, Fed Chair Janet Yellen did not address future monetary policy in her speech but said the financial system is safer now than it was at the time of the financial crisis about a decade ago. She did note regulations may need some adjustments.

European President Mario Draghi is scheduled to speak later in the afternoon Friday.